The above consultation and reply come fromState Administration of Taxation official website, the consultant is myself.

This question didn’t seem like a problem to me, but I’ve encountered it twice in the past six months, so I imagine my translators might encounter it too. I happen to be a law student and a practicing lawyer, having helped hundreds of people pass China’s most difficult bar exam (now the judicial examination). I was once the top candidate in the A‑class bar exam. So, when it comes to questions like this, I can’t help but dig deeper.

Let me briefly explain the principle.

Ostensibly, this issue concerns individual income tax rates. While “royalty income” receives a preferential tax rate of 30% as a government incentive for authors, “labor service income” does not. The actual tax rates calculated for the two generally differ by 4.8% (the former is typically 11.2%, the latter 16%). To put it simply, if “labor service income” is used as the basis for calculation, the translator’s royalties will be subject to an additional 4.8% withheld from the author’s royalties. This is certainly a matter of money, but it also raises the question of whether translators’ work is equally respected.

So, does the state have explicit regulations on this? Of course there are, but unfortunately, the drafters of the regulations, perhaps assuming they are well-versed in legal theory, and that people from all walks of life (especially those in finance) also have a clear understanding of legal theory, have simply used very legalistic logic to create a “clear” regulation. Article 8, Item (4) of the “Regulations for the Implementation of the Individual Income Tax Law” explicitly lists “translation” as “labor service income,” while Item (5) lists “income derived by an individual from the publication or publication of his or her works in the form of books, newspapers, or periodicals” as “royalty income.” However, Item (5) does not mention the word “translation” at all! Consequently, several publishing houses and related institutions have used this as an excuse to argue that “translation” royalties are not “royalty income.” This logic seems to align with common sense, but from a legal perspective, it is clearly a misconception. Legally speaking, Item (5) includes “the publication or publication of translated works in the form of books, newspapers, or periodicals,” making it a special provision that takes precedence over Item (4) in terms of implementation. The “translation” referred to in item (4) refers to situations such as: on-site oral translation, translation of unpublished documents on behalf of others, etc.

Below is a repost of my discussions with the relevant organizations (the final outcome was a happy one for everyone involved). I’ve omitted any names here, so please refrain from speculation. I believe people are always kind, and misunderstandings are inevitable. We should all discuss things calmly and rationally. This discussion is for your reference only, and you’re free to share it:

【Inquiry】

One question is about the calculation of tax. Could you please ask your company’s finance department to confirm it again?

The current algorithm, I guess, is this formula:X – [X × (1–20%) ×

20%]

Front(1–20%)The amount after deducting the tax threshold is20%It’s the tax rate, there’s no problem with that.

However, according to the relevant regulations I have found, and the explanation on the official website of the State Administration of Finance and Taxation (but I only found2014Year12of the month), the original text is“Income from royalties is subject to a proportional tax rate of 20%, which is reduced by 30% of the taxable amount, resulting in an actual tax rate of 14%.”The relevant URLs are as follows:

http://www.chinatax.gov.cn/n840303/c1439853/content.html

According to this explanation, the formula seems to be:X – [X × (1–20%) × 20% ×

(1–30%)] That is X – [X × (1–20%) × 20%

× 14%]

The gap between the two algorithms is still quite large. The tax rate of the algorithm without the preferential treatment is actually16%, the result of preferential treatment is11.2%, so this question is quite important. Please help confirm it when it is convenient for you.

[Publisher’s response]

Translation fees should be considered as labor remuneration income and should be withheld20%Individual income tax should not be withheld according to the remuneration.14%personal income tax.

According to relevant regulations: Income from labor remuneration refers to the income obtained by individuals from engaging in design, decoration, installation, drawing, analysis, testing, medical treatment, law, accounting, consulting, lecturing, news, broadcasting, translation, manuscript review, calligraphy and painting, sculpture, film and television, recording, video recording, performance, performance, advertising, exhibition, technical services, introduction services (commission), brokerage services, agency services and other labor services.

【Continue discussion】

The first judgment without doubt: labor remuneration income refers to the income earned by individuals engaged in design, decoration, installation, drawing, testing, medical treatment, law, accounting, consulting, lecturing, news, broadcasting,translate, manuscript review, calligraphy and painting, sculpture, film and television, sound recording, video recording, performance, performance, advertising, exhibition, technical services, introduction services (commission), brokerage services, agency services and other labor services.

The second judgment is beyond doubt:Income from royalties is subject to a proportional tax rate of 20%, which is reduced by 30% of the taxable amount, resulting in an actual tax rate of 14%.

The question that raises doubts is:Translation royaltiesIn the endTranslation remuneration in labor remuneration, or count asroyalties?

This actually raises the question of what exactly does “translation” in the first judgment refer to? As we know, “translation” also includes on-site interpretation, translation of written materials not intended for publication, and the publication of translated articles or books. So, does the “translation” in the first judgment truly encompass all types of translation? Doesn’t translated and published works fall within the scope of the government’s preferential incentives for creators?

Upon closer examination, the item listed alongside “translation” in labor remuneration is indeed a “service.” Common sense suggests that “translation” and “writing” are not only very similar, but also comparable in terms of creative difficulty. Therefore, it’s likely that “translation royalties” should actually be taxed at the same rate as “royalties”! — At least, in my many years of dealing with various publishing houses, I’ve never encountered a case where “translation royalties” were classified as “labor remuneration.”

If this inference is not convincing enough, we strongly recommend that your company seriously consult with a tax professional, such as a “Certified Tax Agent.” The following website contains review materials and sample questions (including answers) for the Certified Tax Agent exam for your reference:

http://www.233.com/cta/tax2/Guide/20110829/095426256–3.html

Please note the following example questions:

[Example·Multiple Choice Questions] Among the following items, those that belong to labor remuneration include ( ).

A.Remuneration from personal calligraphy and painting exhibitions

B.Remuneration received for providing copyright to a work

C.Remuneration received for translating and publishing foreign works

D.Remuneration received by university teachers for reviewing manuscripts commissioned by publishers

E.Income from personal subcontracting or subletting

What is the answer? We are most concerned about whetherC? No!! The answer is: [Answer]AD

Why not includeCIs this the payment for publishing the translated work we are discussing now? Read further below for an explanation:

(3) The difference between royalties and labor remuneration: the key is whether the work is published

In other words, for the same “translation” remuneration, when it is considered “royalty income” and when it is considered “labor remuneration” depends on whether it is published!

This understanding is obviously in line with common sense and professional ethics. Because any regulation may have “edge” or “intersection” areas, just like “remuneration for translated publications”, which is exactly the intersection between “labor” and “remuneration”. Which side should it lean towards?

This is a particularly kind reminder, primarily because it may affect your relationship with other translators. Since the government offers this preferential tax rate, it’s a win-win for publishing companies to help translators pay taxes according to the law. If both interpretations are possible, it’s worth clarifying this matter carefully, both out of professionalism and out of a sense of responsibility and friendliness towards your cooperating translators. This is no small matter for translators.

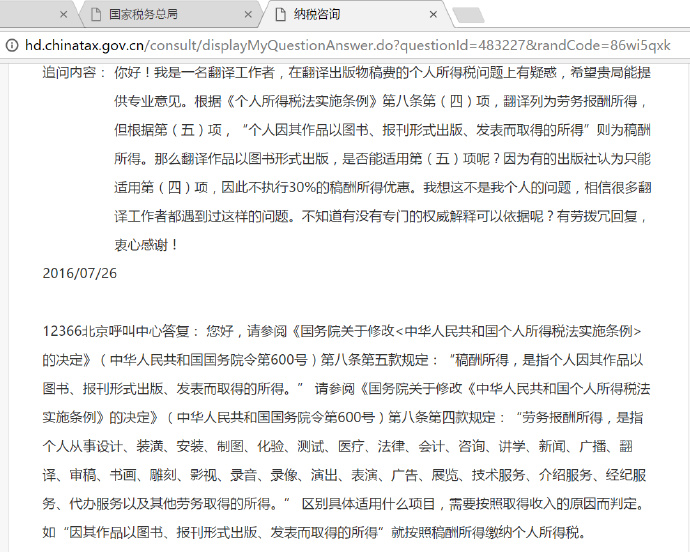

【Inquiry on the State Administration of Taxation website】

Website:http://www.chinatax.gov.cn/

Hello! I am a translator and have questions about the individual income tax on royalties from translated publications. I hope your office can provide professional advice. According to Article 8, Item (4) of the Regulations for the Implementation of the Individual Income Tax Law, translation is classified as labor remuneration income, but according to Item (5),“Income earned by an individual from publishing his or her works in the form of books, newspapers or periodicals”If the translated work is published in the form of a book, can the fifth clause be applied? Because some publishers believe that only the fourth clause can be applied, and therefore do not implement the fifth clause.30%I don’t think this is a personal issue; I believe many translators have encountered this problem. Is there any authoritative explanation I can rely on? Thank you very much for taking the time to respond!

[Response from the State Administration of Taxation website]

12366Beijing call center reply:

Hello, please refer to the “State Council’s Notice on AmendingRegulations for the Implementation of the Individual Income Tax Law of the People’s Republic of China>Decision of the State Council of the People’s Republic of China600Article 8, paragraph 5, of the“Income from royalties refers to the income obtained by an individual from the publication and release of his or her works in the form of books, newspapers and periodicals.”

Please refer to the Decision of the State Council on Amending the Regulations for the Implementation of the Individual Income Tax Law of the People’s Republic of China (State Council Order No.600Article 8, paragraph 4, of the“Income from labor services refers to income earned by individuals from engaging in design, decoration, installation, drafting, laboratory testing, medical treatment, law, accounting, consulting, lecturing, journalism, broadcasting, translation, manuscript review, calligraphy and painting, sculpture, film and television, sound recording, video recording, performance, advertising, exhibitions, technical services, introduction services, brokerage services, agency services, and other labor services.

The specific items that apply should be determined based on the reasons for obtaining income.“Income from publishing his works in the form of books, newspapers and periodicals”Individual income tax is paid based on the income from royalties.

(Feel free to forward this article)